U.S. Government hurling towards debt ceiling default

Image via the New York Times

The U.S. Government is heading towards yet another potential debt ceiling default, in which the government would no longer be able to pay back its debts. Essentially, raising the debt ceiling is like raising our credit card limit. We’ve seen this before, however in every instance so far, a back room deal is cut in the 11th hour to avoid a default. The reason for which is simple: Defaulting on the US debt would be an economic catastrophe of global proportions, according to the US Treasury. Not paying our creditors is like not paying your electric bill. No political party wants to be responsible for plunging the global economy down the drain.

Although the deadline for raising the debt ceiling is January 19th, the US wouldn’t be in real danger of default until June. Often in these situations, more ideologically extreme members of the two major parties are demanding spending cuts to programs they don’t like in the federal budget, or demanding federal spending on something that isn’t included in the budget. The same strategy is often used during government shutdowns, to force an opposition party to give in to political demands.

The feeling these headlines evoke is often one of frustration. Many Americans ask: “How is our tax money being spent?” Raising taxes, especially while inflation is at an all time high, does not sit well with the public. Many feel there isn’t enough transparency about where and how the money is used. The current debt limit for the US Government is around $31 trillion dollars. The heated political battles over how to spend our tax money often undermines the public’s faith in the government. Should the debt ceiling be raised yet again, we’ll still likely find ourselves in this predicament again later this year.

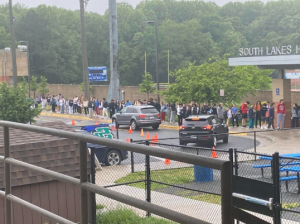

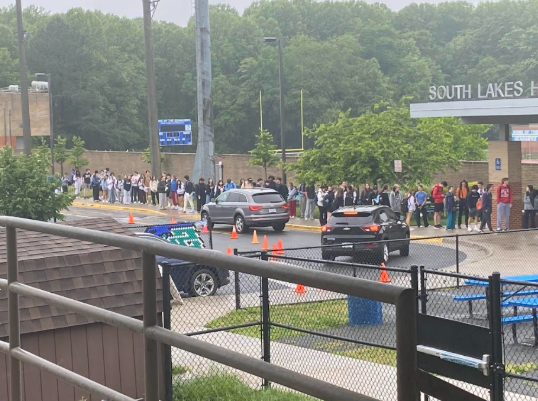

Tadek Wieczorek is a Senior at South Lakes High School. He is highly interested in current news and politics, and hopes to channel these interests into...