US Inflation Reaches 31 Year High

COVID-19 has done its fair share of damage since the first case was discovered, and the United States’ economy is no exception. Demand for businesses plummeted while citizens quarantined and health concerns made it nearly impossible for corporations to keep employees working. However, as the US starts its slow journey back to normalcy, the economy follows, but a bit too rapidly.

The restaurants and grocery stores that decided to slow down shipments and wait to restock until the economic dip was over are now being faced with mass amounts of traffic, and none of the resources to succeed. To put it simply, the pandemic slowed corporate spending down to a trickle and now the faucet is jammed. Companies physically can’t provide the jobs or supplies needed to undergo this switch and global ports have become overcrowded and slow.

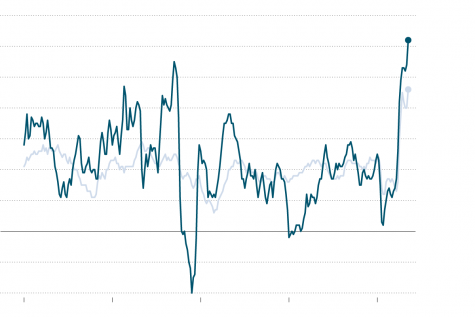

The cost of shipments are rising and, in turn, prices are increasing, as a result of these supply chain bottlenecks. These economic struggles, coupled with government funded 1.9 trillion dollar COVID-19 relief checks, have ignited rapid growth in the United States’ economy. Growth so large, in fact, that “prices have climbed 6.2% — the biggest increase since November 1990, and well above the Federal Reserve’s long-term inflation goal of around 2%,” according to CNN.

These numbers seem small, but looking at what inflation means for US citizens makes it easier to grasp the significance of these changes. For example, these are the prices of household items post-inflation, as provided by the Washington Post, “Bacon prices are up 20% over the past year, egg prices nearly 12%. Gasoline has surged up 50%. Buying a washing machine or a dryer will set you back 15% more than it would have a year ago. Used cars? 26% more.” Items citizens use everyday are being affected by supply chain bottlenecks and the abrupt rise in demand.

It’s projected that inflation will continue to increase into 2022, however, the US economy is still doing well overall. It was able to recover almost instantaneously after the COVID-19 recession, and rapid economic growth was inevitable after getting through a global pandemic. Prices fluctuate and the government responds, it happens time and time again. There’s no need to panic just yet.

To offset this growth, policymakers should focus on ensuring global supply chains are back to pre-pandemic efficiency as soon as possible, and limiting emergency stimulus. Increasing interest rates would also be useful in slowing rapid inflation, as the more expensive money is to borrow, the less individuals and businesses will want to.

Coronavirus stunted the US’s economy, and while it’s risen past its mid-pandemic low, there are still some issues the government must address before America’s completely back to normal.

Sophia Paradowski is currently a sophomore at South Lakes High School. This is her first year writing for The Sentinel and she is looking forward to being...